Votre panier est vide.

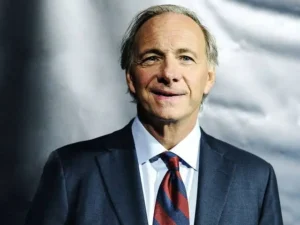

How Countries Go Broke

130,00 DH

Discover the economic patterns that lead nations to financial crisis from the investor who predicted the 2008 collapse.

Ray Dalio reveals his “Big Debt Cycle” framework in clear, accessible language anyone can understand.

Learn how excessive debt threatens even the strongest economies and what warning signs to watch for.

This #1 New York Times bestseller connects economic forces with political, technological, and natural factors.

Gain practical insights for navigating today’s complex financial landscape with greater confidence.

Dalio’s nonpartisan analysis provides solutions, not just problems, for our current economic challenges.

Essential reading for investors, policymakers, and anyone concerned about our economic future.

A timely warning that could help you prepare for what’s coming in the global economy.

🌍📉💡

Description

In “How Countries Go Broke: The Big Cycle,” Ray Dalio, one of the most successful investors of our time, delivers a groundbreaking analysis of the economic forces that can lead nations to financial collapse. Having accurately predicted the 2008 global financial crisis and the 2010-12 European debt crisis, Dalio shares his decades of experience studying economic patterns to explain what he calls the “Big Debt Cycle.” This comprehensive work provides readers with a clear framework for understanding how excessive debt accumulation can threaten even the most powerful economies, including the United States with its status as a major reserve currency country.

Dalio’s methodology combines historical analysis with contemporary economic data to illustrate how debt cycles operate across different nations and time periods. He demonstrates that these cycles aren’t random events but follow predictable patterns that, when recognized early enough, can be managed effectively. The book is filled with accessible charts and real-world examples that make complex economic concepts understandable to readers regardless of their financial background, while still providing valuable insights for professional economists and policymakers.

Beyond just debt analysis, Dalio connects economic factors to the broader “Overall Big Cycle” that includes political dynamics within countries, geopolitical tensions between nations, natural disasters like pandemics and climate events, and technological revolutions—particularly artificial intelligence. This holistic approach reveals how these forces interact to reshape global power structures and economic stability. The book positions current economic challenges within this larger historical context, helping readers understand where we stand in the current cycle and what might come next.

What makes this work particularly valuable is Dalio’s nonpartisan approach and his focus on practical solutions rather than political finger-pointing. He outlines surprisingly straightforward approaches for addressing the debt problems facing major economies including the US, Europe, Japan, and China. Rather than predicting inevitable doom, Dalio provides actionable insights for policymakers, investors, and citizens who want to navigate these challenging economic waters with greater understanding and preparation.

For anyone concerned about the future of the global economy, this book serves as both a warning and a guide. Dalio’s clear writing style, combined with his proven track record in anticipating economic shifts, makes this an essential resource for understanding the economic challenges of our time. By reading this work, individuals can gain the knowledge needed to make more informed decisions in their professional and personal financial lives, while also developing a deeper appreciation for the complex forces shaping our world.

Avis

Il n’y a pas encore d’avis.